I’ve taught more than 4,000 students how to manage their money. They almost always think that saving money from your summer job = not having fun. They’re wrong.

Through my company, Don’t Freak Out!, I’ve discovered that an alarming number of students think that if they’re saving money, then they can’t be spending anything on going out or having fun. This is a big misconception that I’m going to fix right now.

Here are 5 steps you can to seriously save money from your summer job.

1. Figure Out Your Disposable Income

This is the easy part. Figure out how much money you have coming in regularly that is disposable (meaning money you can use that isn’t going to necessary expenses).

For example, if you’re going to work 20 hours/week this summer and are making $14/hour, you’re going to bring in about $280/week. This works out to about $1,120/month. We’ll call this your total monthly income.

Let’s say your only monthly expense is a phone bill for $50/month. This would total to $50 in expenses that you have to pay each month.

Assuming you had no other necessary expenses (meaning things you absolutely have to pay each month like rent or bills), your disposable income would be $1,070/month. We got this number by subtracting your total necessary expenses from your total monthly income.

2. The 30% Rule

In my opinion, as a student, you should be saving at least 50% of your total monthly income (not your disposable income). I realize this is a bit aggressive, so let’s aim for a more realistic 30%. That would still be considered a very good portion of your total monthly income to be saving. If you lived your entire life saving 30% of your income, you would be in a really great financial position.

Let’s go back to that initial example.

Your total monthly income is $1,120, and 30% of that number is $336. That means you should be saving $336 every single month.

I want you to think of this savings target as a necessary expense. This way, your disposable income will have already considered the amount you need to be saving. For example, in the previous step, we established that your disposable income would be $1,070/month after expenses. Factor in your savings goal, and your disposable income is actually $734 ($1,070 – $336 = $734).

3. Set Up a Savings Account and an Auto-Transfer

To make sure that you are saving properly, I recommend setting up a separate chequing or savings account with your bank. Just go into the branch and tell them you want a separate account to put your savings in. Some banks even have free accounts with interest rates, so you make money on your money.

(CIBC, in particular, has some great account options for student banking.)

Once you open a separate account, ask your bank how to set up an automated money transfer every payday. This will automatically transfer a certain amount of money from your chequing account into your savings account on your payday, so you won’t even realize that the money is gone.

Going back to the original example, you should have $560 deposited into your bank account every 2 weeks (assuming you’re paid every 2 weeks). From that $560, you would want to set up an automated transfer for $168 (half of your savings goal of $336/month) from your chequing account into your savings account. Subtract $25 (half of $50) for your monthly expenses.

You would have $367 left over in your account every 2 weeks. Now you’re saving money, but you’re not done yet!

4. Watch Your Savings Grow (and Don’t Touch Them)

Once you have this transfer set up, you are ready to be successfully saving money for the rest of the summer.

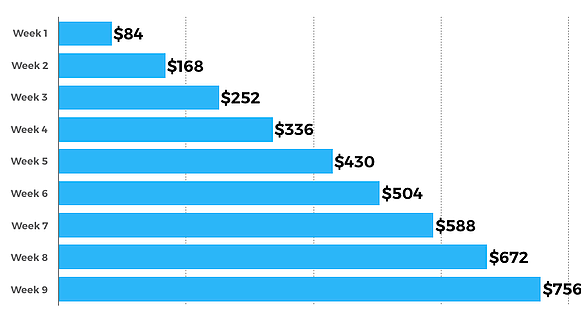

Let’s take a look at how much money you could save had you started on July 1, working 20 hours/week until September 1:

$756 saved by the end of two short months! That’s enough to pay for all of your textbooks for the year. Pretty awesome, right? Even if you only started saving money at the beginning of August, you could still be looking at savings of $336 in just four weeks.

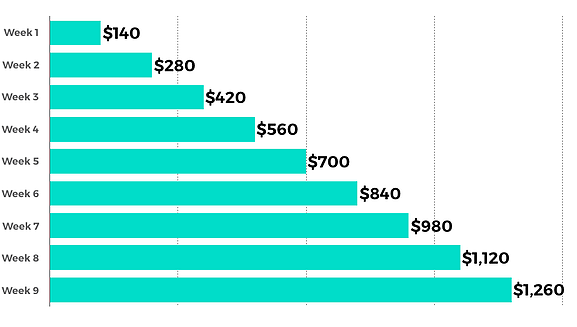

Now, I hate to be that guy, but here’s how much you would have if you saved 50% of your total monthly income instead of 30%:

$1,260! That’s enough to pay for all of your textbooks this year and half of your textbooks for next year. I’ll leave the receipts on the table for you to collect…

5. Enjoy Your Summer

I want to make this abundantly clear: by saving money with this 30% model, you still have more than enough spare funds to spend on activities, clothes, food, and whatever else you want.

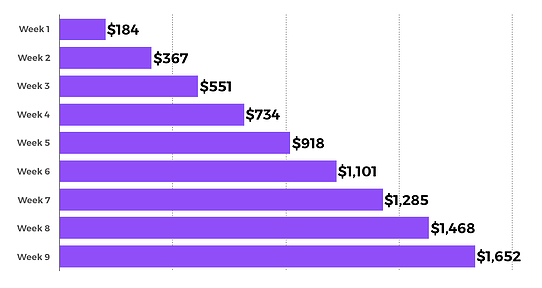

How much exactly, you ask? Let’s take a look at how much disposable income you still have over the entire summer:

There you have it. By saving money for just 9 weeks, you would still have a total of $1,652 to spend on whatever the heck you want. Not only do you get a fat amount of money to spend on McDonald’s (no, is that just me?), you are still saving almost $1,000 for your future. That, my friends, is called responsible adulting.

*drops mic*

READ MORE: A Student’s Guide to Making Money Online

More top resources just for students

*Opinions expressed are those of the author, and not necessarily those of Student Life Network or their partners.